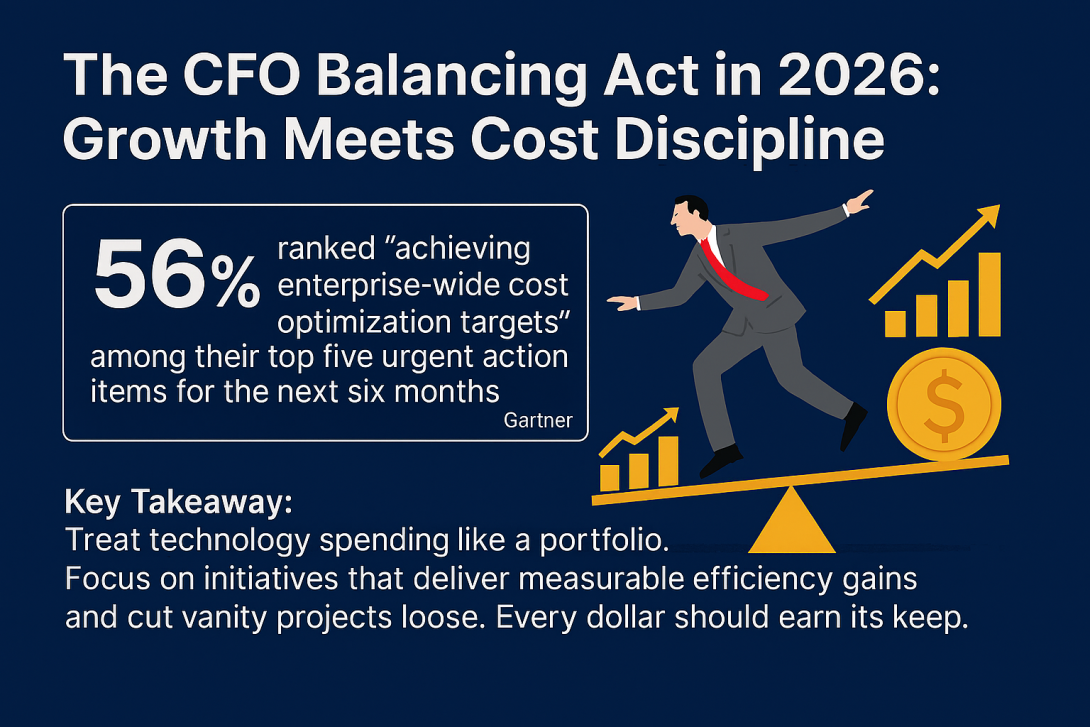

Here comes 2026, where CFOs face a challenge that feels almost theatrical: grow faster while spending less. According to a recent Gartner survey of more than 200 finance chiefs, 56 percent ranked “achieving enterprise-wide cost optimization targets” among their top five urgent action items for the next six months. In other words, efficiency the top priority. [https://ww...ns-2026...]

Here is the kicker. While tightening budgets, CFOs are also expected to fund innovation, especially in AI and automation. The era of “AI experiments” is over. Boards and investors expect measurable returns on technology investments, not futuristic promises. That means CFOs need to master tech ROI and move beyond static cost-benefit charts to dynamic models that account for scalability and risk.

Why should small and mid-sized organizations care? Because the tools that were once reserved for Fortune 500 companies such as predictive analytics, AI-driven forecasting, and automated compliance are now within reach. The real challenge is not access. It is prioritization. CFOs who strike the right balance between cost optimization and strategic tech investment will set the pace for 2026.

Key Takeaway: Treat technology spending like an investment portfolio. Focus on initiatives that deliver measurable efficiency gains and cut vanity projects loose. Every dollar should earn its keep.